8 Reasons Why Your Tech Stack Must Flex Between Suburban BtR and Multifamily BtR

The UK Build to Rent (BtR) sector is evolving at speed. A model once based on urban multifamily living units has since branched into another area: the Suburban BtR (SBtR), otherwise known as single-family housing. A multifamily building is a single asset with shared systems; whereas an SBtR community is a distributed network of individual homes that together create a neighbourhood. According to Knight Frank’s 2025 UK BtR Update report, ‘Single-family housing accounted for 25% of total BTR delivery in 2025, up 14% year-on-year and the highest share on record, a reflection of rising levels of investment.’ The report also highlighted that UK BtR investment reached £4.7 billion in 2025, with SBtR accounting for 55% of total annual investment, overtaking multifamily for the first time.

As SBtR accelerates – driven by a demand for space, affordability and family‑oriented living – operators are also discovering that the digital infrastructure required to run these communities looks very different from the tech stack used in dense, urban multifamily BtR.

To operate efficiently, deliver a consistent resident experience, and scale portfolios across both asset types, your technology must flex.

Below are the key reasons why.

1. Resident Profiles Are Fundamentally Different

SBtR generally attracts families, long‑term renters and residents who prioritise space, stability and a strong sense of community. Real estate technology consultants Red Direct point out that in terms of tenancies, SBtR ‘Is the perfect way to bring in people who want a family home because they have outgrown apartment living.’ Multifamily BtR, on the other hand, tends to attract younger professionals who expect high‑frequency digital interactions and amenity‑rich living.

If you’re operating both SBtR and multifamily BtR, you will be facing residents with differing priorities and expectations and your tech stack must adapt to accommodate. This means ensuring you provide suitable communication styles, onboarding flows and content delivery to suit each demographic, not try to satisfy both with the same digital journey.

2. Operational Models Don’t Match

Multifamily BtR developments typically have an on‑site team, concierge desk, parcel room and centralised service points, and this is a trend only set to grow. ‘Working from home has driven much greater daytime utilisation of shared amenity areas, which in turn calls for a greater variety of spaces, from private areas for video calls to dual-purpose dining/meeting rooms to large shared worktables with good lighting,’ explains Rory O’Hagan, Principal of Living at Arcadis Architecture and Urbanism, in Showhouse magazine. SBtR developments, however, often operate with leaner staffing and are made-up of widely dispersed homes across a neighbourhood‑style layout.

Urban schemes will therefore require tech that supports a high‑volume of interactions, including those that can support access control, amenity booking and parcel management, for instance. Conversely, suburban schemes need tech that supports remote operations, such as digital move‑ins, remote inspections and IoT monitoring.

3. Geographic Spread Changes the Digital Infrastructure

In SBtR, ‘Demand is driven by families and mid‑career professionals seeking long‑term rental housing with space and community amenities,’ explains residential apartment block marketplace platform, Blockeo. In multifamily BtR, the majority of tenancies will be held by young professionals, who are typically drawn to renting an apartment in an urban setting, in order to be close to work and friends.

SBtR therefore requires a system that works for its resident from afar, such as mobile‑first platforms, cloud‑based systems and remote diagnostics. Multifamily developments, which generally also house a larger on-site team, can also rely on building‑level hardware and face-to-face support.

4. Amenity Expectations Are Not the Same

Urban BtR leans heavily on gyms, co‑working spaces, lounges and parcel rooms, and can benefit financially from these features. Blockeo highlights ‘BtR schemes generate income through rent, ancillary services (parking, storage, coworking), and amenity subscriptions.’ They go on to reveal that these additional features help BtR command 9-12% higher rental than its private rental stock comparison. SBtR has a different focus, where the priorities lean towards green space, family‑friendly features and community‑oriented design.

These differing approaches to the tenancy should be reflected in your tech stack, which must be able to support different amenity profiles, whether that means effective systems for booking amenities and shared spaces, or providing effective community engagement tools.

5. Marketing and Leasing Journeys Diverge

Multifamily BtR, by its very nature, relies on fast leasing cycles. This is driven by its appeal for younger renters and therefore can often have a high turnover. SBtR, by contrast, attracts residents making more considered, long‑term decisions. According to Director Michael Swiszczowski and Architect Catalina Ionita, the ‘SBtR model typically tends to have less turnover, the operational costs are also lower, as tenants are more likely to stay longer than those in urban settings.’ This is expected to be a pattern with a long trajectory. ‘As the average age of first-time buyers continues to rise, the time spent in the rental sector is lengthening, reinforcing sustained demand for rental homes and creating a stickier tenant base for BtR,’ explains Knight Frank.

With the occupational expectations and tenancy lengths so different, it is vital that your CRM, lead‑nurture flows and digital content can flex to match the pace and expectations of each audience.

6. Maintenance Profiles Vary Significantly

Suburban homes, commonly houses, often include boilers, gardens, driveways and individual systems provided for each plot, which require more complex maintenance. Multifamily buildings, however, share systems among multiple plots, such as lifts, a central power and heating plant, and shared infrastructure.

Choosing the right tools for maintenance is paramount. As Blockeo reveals, ‘Operators report 5–8% reductions in OpEx after implementing predictive‑maintenance solutions and smart‑metering platforms. Digital leasing systems also shorten vacancy periods, supporting occupancy above 96%.’ Your maintenance technology will therefore need to support different workflows and Service Level Agreements, if operating in both areas. This will be especially important as SBtR expands, which seems likely with house prices remaining high and deposits for homeownership becoming further and further out of reach.

7. Resident Experience Platforms Must Reflect Lifestyle Differences

Urban, mulitfamily renters expect instant communication, app‑based access and smart building features. Suburban renters expect clear home information, easy maintenance reporting and neighbourhood‑level updates.

Your resident experience platform must be able to adapt its user experience, content and communication style to each of these environments.

8. Investors Track Different KPIs

As BtR has branched out into the suburbs, investors have had to reassess how they track different performance metrics depending on the asset type. For urban, multifamily BtR, the focus is on occupancy velocity, amenity utilisation and operational efficiency, whereas SBtR sets its sights on retention, maintenance cost per home and overall community satisfaction.

In order to exemplify performance, your tech stack must allow for flexible reporting dashboards, which can be tailored to each asset type.

Where Spaciable Fits In

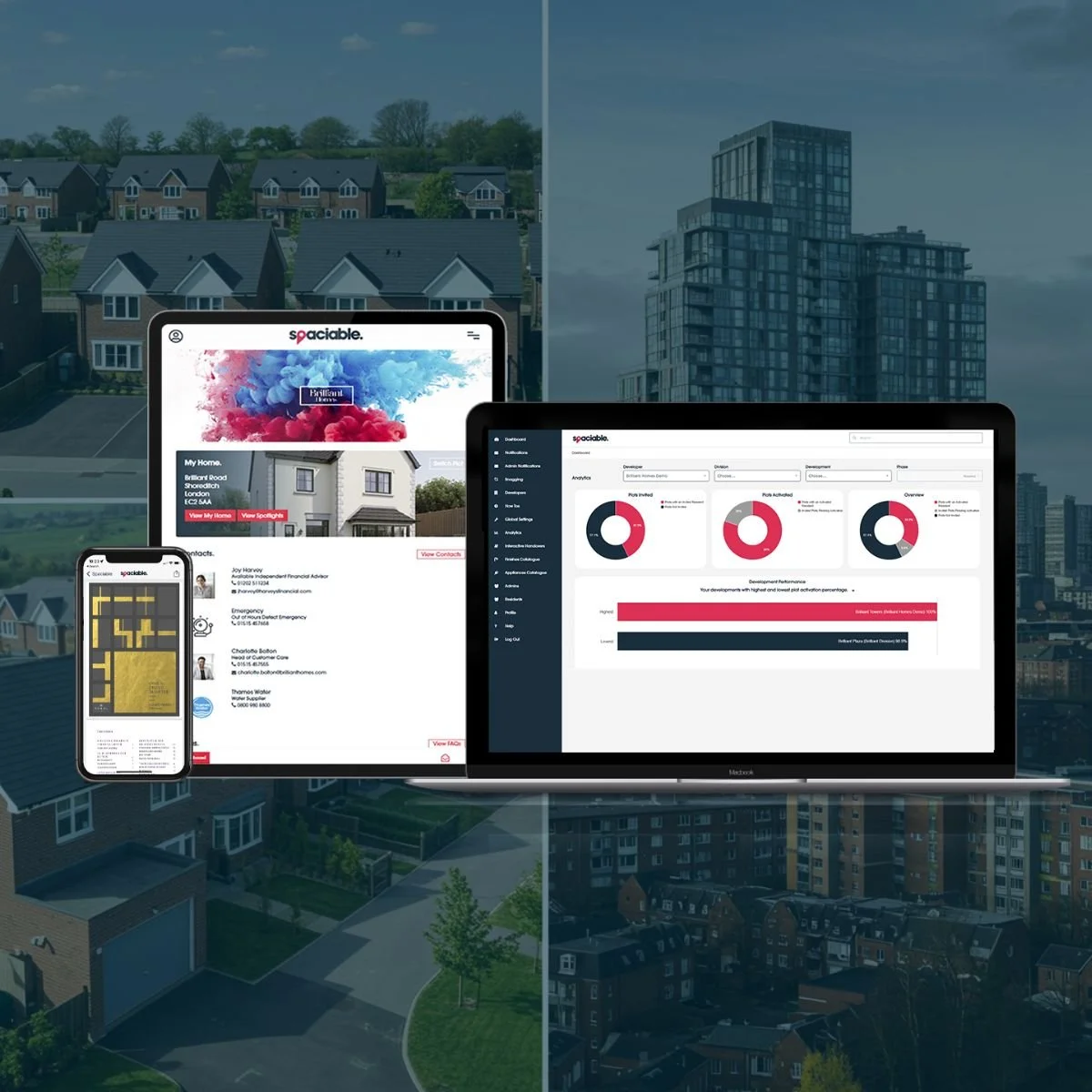

As portfolios diversify, operators need a resident experience platform that can flex as easily as their assets do.

Spaciable is designed to support both suburban and multifamily BtR by:

Delivering consistent, branded home information across any asset type

Supporting remote management for suburban communities

Providing digital move‑ins, maintenance reporting, and resident communication tools

Offering content that adapts to different resident profiles and property types

Integrating seamlessly with wider tech stacks, regardless of operational model

Whether you’re managing a single urban tower or a dispersed suburban neighbourhood, Spaciable ensures residents receive the clarity, support, and digital experience they expect, without forcing operators into a one‑size‑fits‑all system.

FAQ

Do suburban and multifamily BtR really need different tech?

Yes – the operational realities, resident expectations, and physical layouts differ enough that a flexible tech stack is essential.

Can one platform serve both asset types?

Yes, but only if it’s designed to flex. Platforms like Spaciable adapt content, workflows, and communication styles to each environment.

Why does this matter for operators?

Because mismatched tech leads to inefficiencies, poor resident experience, and higher operational costs, especially as suburban BtR continues to grow.

Is suburban BtR really growing that fast?

It is. Knight Frank, CBRE, and Savills all report that Single Family BtR is now attracting the majority of new investment, outpacing multifamily for the first time.

If you’re operating in the BtR sector, whether urban, suburban, or both, please get in touch to discuss the flexibility of your tech stack and what we can do to help.